Is the Social Security Act Socialistic?

“Am I my brother’s keeper?”

From a previous posting: “… The Social Security Act was signed into law by President Roosevelt on August 14, 1935.

In October of 1929, the “Great Depression” began, and “by the time that FDR was inaugurated president on March 4, 1933, the banking system had collapsed, nearly 25% of the labor force was unemployed.”

On September 1, 1939, a little more than four years after the signing of the act, World War II began. So, the American workforce was reeling and struggling for survival.

…The United States Census Bureau statistics show that between 1940 — 1960, there was a booming population increase of nearly 45 Million, and those 45 million are now at, in, or approaching retirement. So, are they better off? Sure they are! They have had 65 — 75 years to work, save, and build that SSI that the government promised!”

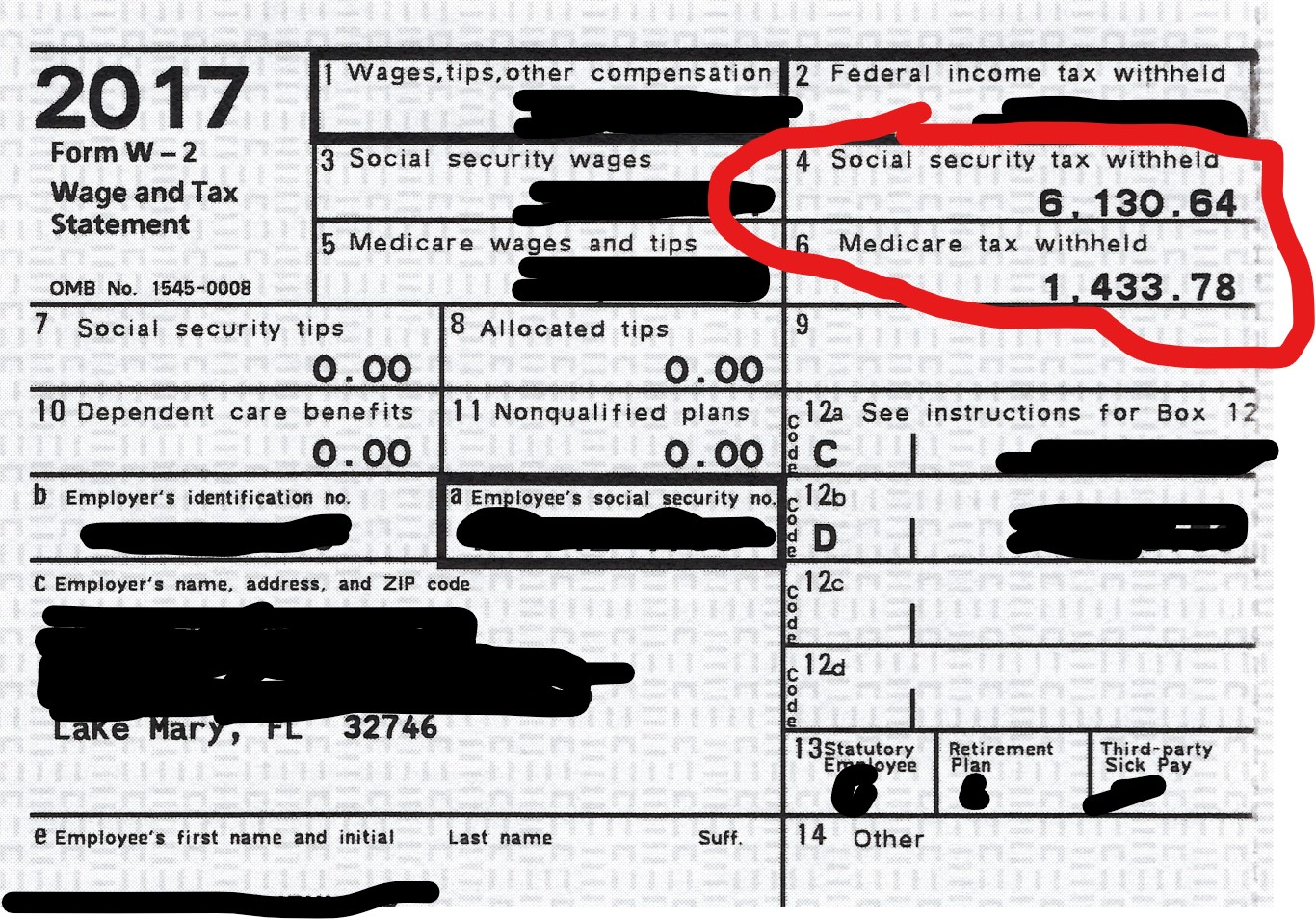

Taxes paid for 50+ years…Hypothetically speaking:

What does it amount to? Well, suppose you earned today’s maximum taxable amount of ($168,600) annually (paying 1.45% Medicare / 6.2% Social Security), in which case, your employer would pay a matching SS tax on that same $168,600.

Now, let’s say that happened for 50 years. What would the government have taken?

- Annual Salary withholding: $168,600

- SS EE $10,453.20 per annum (employee paid)

- SS ER $10,453.20 per annum (employer matching)

- Total Withheld: $20,906.40 per annum over 50 years = $1,045,320

- Medicare Withheld: 1.45% of TOTAL EARNINGS

- Assuming that you earn $168,600 per annum = $2,444.70 * 50yrs = $122,235 total

Your total collected by the FED equals $1,167,555

What happens if you die BEFORE retiring?

THEY KEEP IT!

Optionally, and by that, I mean depending on the age you are when you ask for it back (which, ironically, is not long before you die), you are allotted a small portion of the total, which is paid in small monthly allotments, and according to “The Act of 1935,” would end with your death or with the death of your spouse should you happen to have married somewhere along the way.

AND THEY KEEP THE REMAINDER!

Reality…

Of course, government studies tell us that what retirees receive leaves them in “a good financial position,” but looking closely at the FED reporting, you will see the results of the TOP MONEY EARNERS when it comes to how well-off anyone will be when they reach retirement age.

As for the common laborer, Walmart employees, retail and factory workers, etc., in other words, the majority of the money earners in the country, it is their earnings that they ignore and grossly underestimate the futures of, and they openly admit that it is these who will “have to struggle on SSI alone.”

So then, Is the Social Security Act of 1935 an act of socialism or altruism?

Many say SOCIALISM, claiming that the “lost money” goes to illegal aliens, immigrants, defense spending, crooked politicians, fake illnesses and disabilities, etc.

What is left OF THOSE MILLIONS for your posterity? Generously, and only under specified circumstances, the U.S. Government will grant your survivors the untaxable amount of $255 for burial expenses. (See: Survivor’s Benefits) All of the money you worked for is then left to The Republic For Which It Stands, i.e., the one that demanded it of you, and for them to distribute as they see fit.

For immigrants, yes, according to the Social Security Administration’s ‘Spotlights‘ page, certain immigrant citizens (i.e., refugees, non-citizens, and “illegals”) can qualify for benefits under certain conditions.

For Example:

There are 7 categories of qualified aliens. You are a qualified alien if the Department of Homeland Security (DHS) says you are in one of these categories:

Lawfully Admitted for Permanent Residence (LAPR) in the U.S., which includes”Amerasian immigrant” as defined in P.L. 100-202, with a class of admission AM-1 through AM-8;

Granted conditional entry under Section 203(a)(7) of the Immigration and Nationality Act (INA) as in effect before April 1, 1980;

Paroled into the U.S. under Section 212(d)(5) of the INA for a period of at least one year;

Refugee admitted to the U.S. under Section 207 of the INA;

Granted asylum under Section 208 of the INA;

Deportation is being withheld under Section 243(h) of the INA, as in effect before April 1, 1997; or removal is being withheld under Section 241(b)(3) of the INA;

- A

“Cuban or Haitian entrant” as defined in Section 501(e) of the Refugee Education Assistance Act of 1980 or in a status that is to be treated as a “Cuban/ Haitian entrant” for SSI purposes.

In addition, you can be a “deemed qualified alien” if, under certain circumstances, you, your child, or your parent were subjected to battery or extreme cruelty by a family member while in the United States. (See the website for more details)

For those OTHER groups who are permitted to receive Social Security Income (SSI), the list is very long, varied, full of rules and regulations, and available to the public regardless of having paid or not paid into the fund. (See: SSI Eligibility) However, the government is supposedly forthcoming with any and all information you may have questions about.

But how does it all add up? What is the true nature of Social Security Income?

Is it Socialism or Altruism?

Sadly, in our society, altruism is far too often taken advantage of. It permits the indolent, slothful, lazy, and decrepit to take advantage of the working-class citizen. The Act of 1935 might be an excellent program if it could be and had been properly administrated. Still, by all appearances, it has lost its focus and its ability to realize what it was intended to accomplish. Consequently, it is now threatened with extinction.

Personally, my wife and I are somewhat disconcerted over the fact that, despite the monies that were taken from us, we will never see, in total, all that could be realized with those funds. Should we look at the funds from the altruistic standpoint of, “Oh well, others need it too.” Or from the capitalistic viewpoint of, “We are not going to have enough to carry us through our senior years if we live that long.” Also, “Why should our money go to strangers, immigrants, et al., when OUR FAMILY needs it?

What do you think? How do you feel about the SSI ACT of 1935 being repealed? Should it be repealed? Do you think that the government owes us that money?

Follow my Facebook page and comment at: NoEasyStreet

Share This Story:

Leave A Comment

You must be logged in to post a comment.